How Xero simplifies bookkeeping for entrepreneurs and freelancers by automating tasks, saving time, and offering real-time financial insights for better decision-making.

By Veronica Wade, Thomas Edward Published: September 3, 2025

Introduction: The Bookkeeping Struggles Entrepreneurs and Freelancers Face

Bookkeeping has always been one of the least glamorous tasks for entrepreneurs and freelancers. Between sending invoices, chasing payments, and tracking expenses, it’s easy to get overwhelmed. For freelancers with irregular income and entrepreneurs juggling multiple clients or projects, keeping accurate and up-to-date records can be a daunting task.

That’s where Xero comes in. It’s designed to take the pain out of bookkeeping, providing business owners with a simple, efficient, and reliable way to manage their finances without requiring a trained accountant.

Why Choosing the Right Accounting Software Matters

The Hidden Cost of Manual Bookkeeping

Manual bookkeeping often means hours spent updating spreadsheets or collecting receipts. This not only wastes time but also increases the chances of errors that could affect tax filings or cash flow planning.

Time-Saving Benefits of Automation

With automation, Xero removes repetitive tasks. From reconciling bank transactions to auto-sending invoices, it allows business owners to focus more on growth and less on paperwork.

What Makes Xero Different from Other Cloud Accounting Tools

A Brief Overview of Xero

Xero is a cloud-based accounting software founded in New Zealand, now trusted by over 3.5 million subscribers worldwide. It’s known for its user-friendly interface, integrations, and affordability.

Key Features Tailored for Entrepreneurs

- Easy multi-user access

- Scalable pricing plans

- Integration with 1,000+ apps

Why Freelancers Love Xero

Freelancers benefit from quick invoicing, simplified expense tracking, and real-time cash flow visibility.

Core Features of Xero That Simplify Bookkeeping

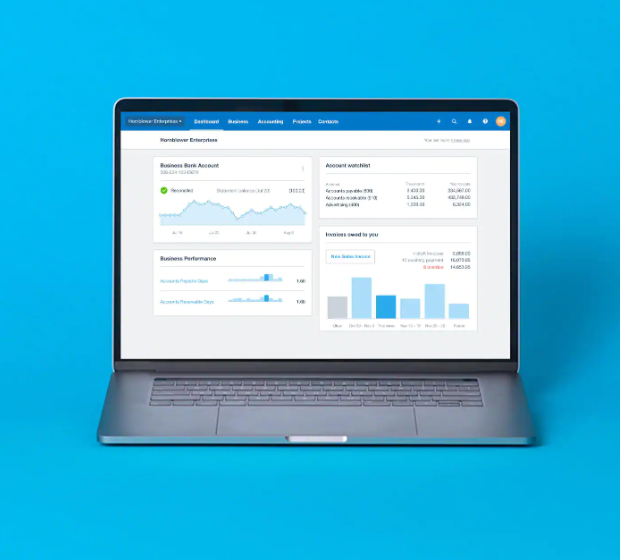

Bank Reconciliation Made Easy

With Xero, connecting your bank account means every transaction flows into your dashboard. Reconciling transactions becomes a one-click process.

Invoicing in Just a Few Clicks

Xero lets you create professional invoices that can be automated and sent directly to clients. You can also set reminders for late payments.

Expense Tracking Without the Stress

Simply snap a photo of a receipt, and Xero automatically categorizes it—making tax time less stressful.

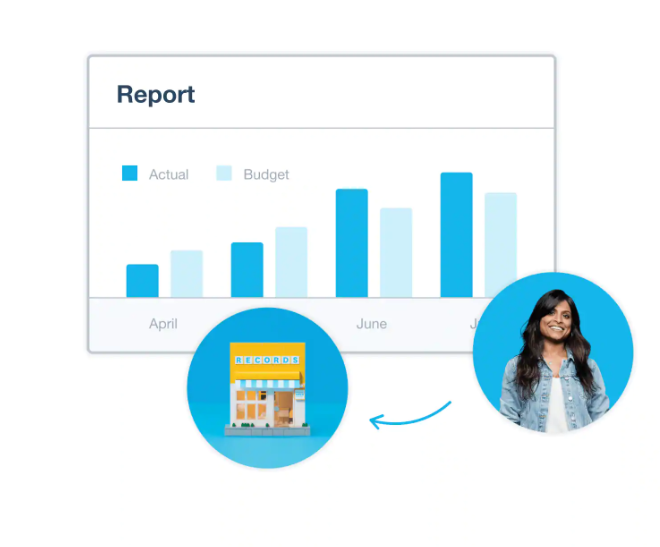

Real-Time Financial Reporting

Xero provides dashboards and reports that give you insights into profit, expenses, and cash flow.

How Xero Supports Freelancers Specifically

Managing Irregular Income

Freelancers often deal with inconsistent payments. Xero’s real-time income tracking helps forecast cash flow more accurately.

Tracking Billable Hours and Client Payments

By integrating with project management tools, freelancers can log billable hours directly and invoice seamlessly.

Staying Tax-Ready Year-Round

Xero automatically organizes expenses, making quarterly and annual tax filing simpler.

Benefits for Entrepreneurs Running Small Businesses

Multi-User Collaboration

Entrepreneurs can invite accountants, team members, or financial advisors into their Xero account with role-based permissions.

Cash Flow Forecasting for Growth

Xero includes cash flow tools to help predict whether your business can afford future investments.

Integration with Business Tools

From PayPal to Shopify, Xero integrates with apps that entrepreneurs already use daily.

Comparing Xero to Competitors

Xero vs QuickBooks

QuickBooks has a strong U.S. presence, but Xero is often considered more intuitive and affordable for freelancers.

Xero vs FreshBooks

FreshBooks is great for invoicing, but Xero offers a full accounting suite at a similar price.

Xero vs Wave

Wave is free but limited in scalability. Xero offers more advanced features suitable for growth.

Security and Reliability in the Cloud

Data Protection and Encryption

Xero uses bank-grade encryption and two-factor authentication to protect sensitive data.

Accessibility Anywhere, Anytime

Being cloud-based, Xero works across devices—desktop, tablet, and mobile.

Pricing Plans That Suit Freelancers and Entrepreneurs

Starter Plan for Beginners

Great for freelancers sending a limited number of invoices.

Standard and Premium Plans

Best for entrepreneurs managing larger teams and complex bookkeeping.

Value for Money

Compared to alternatives, Xero balances affordability with advanced features.

Start with Xero Promo Deal (90% OFF FOR 4 MONTHS)

Case Studies: Real Success Stories

Freelancer Example

A freelance graphic designer switched from spreadsheets to Xero and reduced monthly bookkeeping time by 70%.

Entrepreneur Example

A café owner used Xero integrations with POS systems to streamline daily sales tracking, improving cash flow management.

FAQs

1. Is Xero better than QuickBooks for freelancers?

Yes, Xero is often preferred for its simpler interface and cost-effective plans for freelancers.

2. Can I use Xero without an accountant?

Absolutely. Xero is designed for non-accountants but also allows easy collaboration with professionals if needed.

3. How much does Xero cost per month?

Plans typically start around $13/month for freelancers and scale up depending on features.

4. Does Xero integrate with payment systems like PayPal or Stripe?

Yes, Xero connects with PayPal, Stripe, and dozens of other payment processors.

5. Is Xero secure for storing financial data?

Yes, Xero uses top-tier encryption and cloud security protocols.

6. Can I manage taxes directly with Xero?

Yes, Xero helps organize income and expenses, making tax filing easier, though many still consult accountants for final submissions.

Conclusion: Why Xero is the Smart Choice for Modern Bookkeeping

For entrepreneurs and freelancers, time is money. Xero simplifies the bookkeeping process with automation, easy invoicing, and real-time insights, giving business owners more time to focus on what truly matters—growing their business.

If you want a bookkeeping tool that’s secure, scalable, and designed for the modern professional, Xero is one of the best choices available today.