Introduction: The Rise of Cloud Accounting

Small businesses can’t afford to waste time on outdated, manual accounting processes. Cloud accounting software has revolutionised the way entrepreneurs manage their finances, offering automation, mobility, and enhanced insights. Among the many available solutions, Xero consistently stands out as the best cloud accounting software for small businesses.

In this article, we’ll dive into the 12 proven reasons why Xero is the go-to platform for small business owners worldwide.

What Is Xero and Why Small Businesses Love It

Xero is a cloud-based accounting platform designed for small to medium-sized businesses. Founded in 2006 in New Zealand, it has grown to become one of the most trusted names in cloud accounting. What makes it shine is its simplicity, powerful features, and scalability.

Instead of being bogged down by spreadsheets or confusing desktop tools, Xero allows businesses to:

- Access accounts securely from anywhere

- Automate transactions

- Collaborate with accountants in real time

- Get instant insights into their financial health

With more than 3.7 million subscribers worldwide, Xero continues to empower small businesses to focus less on bookkeeping and more on growth.

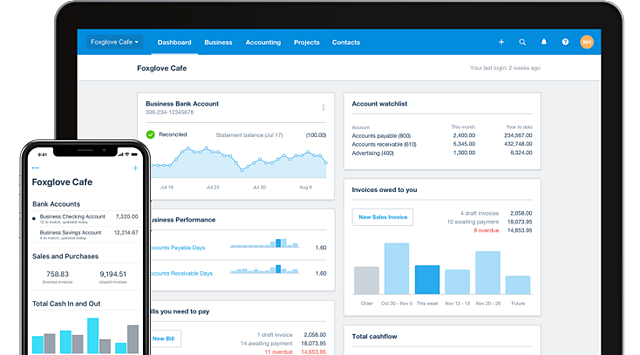

1. User-Friendly Interface for Beginners and Experts

When small business owners think about accounting software, one of the biggest fears is complexity. Accounting itself can feel overwhelming—tax rules, compliance issues, invoices, and cash flow management often intimidate people who aren’t trained accountants. That’s where Xero’s user-friendly interface comes in.

Designed With Simplicity in Mind

Xero was built to be intuitive from the ground up. Its dashboard provides a clear snapshot of your financial position the moment you log in. You can instantly see:

- How much money is coming in and going out

- Pending invoices and overdue bills

- Current bank balances synced directly from your accounts

Unlike older systems that bombard you with jargon, Xero uses plain, easy-to-understand language. Even if you’ve never used accounting software before, you can find your way around without feeling lost.

Onboarding Made Easy

For beginners, the initial setup process is straightforward. Xero walks you through linking your bank account, setting up invoice templates, and adding contacts. If you’re migrating from another platform, such as QuickBooks or Excel, Xero offers import tools to transfer your data.

This smooth onboarding process saves valuable time. Instead of spending days learning how the software works, you can start managing finances almost immediately.

For Accountants and Experts Too

While it’s beginner-friendly, Xero doesn’t sacrifice functionality for simplicity. Accounting professionals appreciate its robust reporting tools, audit trails, and ability to handle complex tasks like multi-currency transactions and advanced reconciliation.

This dual focus means a small business owner can comfortably use Xero day to day, while their accountant can dive into deeper insights when necessary. It bridges the gap between non-finance professionals and seasoned accountants.

A Comparison with Competitors

When stacked against competitors like QuickBooks Online, FreshBooks, and Wave, Xero shines for its balance of usability and depth. QuickBooks, for example, is powerful but often criticised for being clunky and overwhelming for beginners. FreshBooks is simple but lacks some advanced accounting tools. Xero hits the sweet spot in between: powerful yet approachable.

Accessibility Across Devices

Another reason Xero feels user-friendly is its availability across platforms. Whether you’re at your desk using a desktop or on the move with your smartphone, Xero provides the same seamless experience. The mobile app allows you to:

- Send invoices on the spot

- Upload expense receipts by snapping a photo

- Check balances in seconds

This ensures you never feel disconnected from your financial data.

Why This Matters for Small Businesses

For small businesses, time is money. Spending hours trying to figure out how to send an invoice or reconcile bank transactions is time wasted. By making accounting accessible—even to those without financial backgrounds—Xero frees entrepreneurs to focus on running and growing their business instead of drowning in numbers.

👉 In short, Xero’s user-friendly interface makes it possible for anyone to feel confident handling their finances, whether they’re a freelancer just starting out or a growing SME with multiple accounts.

2. Cloud-Based Flexibility Anytime, Anywhere

One of the greatest advantages of Xero is its cloud-based accessibility. In a business landscape where remote work and global teams are now the norm, small businesses need software that isn’t tied to a single computer or office. Xero delivers on this promise by allowing you to access your financial data securely from anywhere in the world.

Work From Anywhere

Because Xero is hosted in the cloud, you don’t need to worry about installing software or being limited to one device. Whether you’re at your office desk, working from home, or travelling abroad, your financial information is just a login away. All you need is an internet connection.

This flexibility is especially valuable for entrepreneurs who are constantly on the go. For example, a consultant meeting a client overseas can quickly generate an invoice on their tablet. A retailer attending a trade show can check sales data in real time from their smartphone. Xero ensures you’re never disconnected from the financial pulse of your business.

Multi-Device Access

Xero’s platform works seamlessly across laptops, tablets, and smartphones. Its mobile app is particularly powerful—it’s not just a watered-down version of the desktop platform. You can:

- Reconcile bank transactions

- Send invoices instantly

- Capture receipts with your phone camera

- Monitor cash flow in real time

This means financial management no longer has to wait until you’re back at your desk.

Real-Time Updates

Because everything is cloud-based, all updates are instantaneous. If your accountant in another city reconciles your accounts, you’ll see those changes reflected in real time. There’s no risk of data duplication, outdated files, or version conflicts. Everyone—owners, staff, accountants—works off the same live data.

This ensures collaboration stays smooth and decisions are always based on the latest information.

No More IT Headaches

Traditional accounting software often requires manual installation, updates, and backups. With Xero, all updates happen automatically in the background. There’s no need to worry about maintaining servers, upgrading software, or losing data because you forgot to back up.

Xero’s cloud infrastructure also means you benefit from enterprise-level reliability. Downtime is rare, and data is stored securely in multiple servers, reducing the risk of loss.

Why Cloud Flexibility Matters

For small businesses, agility is everything. You might not have a dedicated IT team or the luxury of sitting in one office all day. Xero’s flexibility allows you to operate like a bigger business—responsive, mobile, and connected—without the overhead costs.

👉 In short, Xero’s cloud-based flexibility empowers small businesses to stay in control no matter where life takes them.

3. Seamless Bank Reconciliation

One of the most time-consuming tasks in small business accounting is bank reconciliation. Matching bank statements to transactions can be tedious and error-prone if done manually. Xero transforms this process with its seamless bank reconciliation feature, saving hours of work each week.

Automated Bank Feeds

Xero connects directly with thousands of banks worldwide, pulling your bank transactions into the system automatically. This eliminates the need to download statements manually or enter transactions line by line.

Each morning, your latest transactions appear in Xero, ready for reconciliation. This automation ensures your books stay accurate and up to date.

Smart Matching with Machine Learning

Xero goes a step further by using machine learning to suggest matches. For example, if you paid a supplier $500, Xero will automatically recognize the payment from your bank account and suggest reconciling it with the supplier’s invoice.

Over time, the system learns your habits and gets smarter, making the process even faster. What once took hours can often be done in minutes.

Catching Errors Early

Because reconciliation happens daily instead of monthly, errors are spotted quickly. You’ll notice if a payment didn’t go through, if a customer underpaid, or if there are duplicate transactions. Early detection prevents small issues from becoming costly problems down the line.

Custom Rules for Recurring Transactions

Xero allows you to set up bank rules for recurring expenses. For instance, your monthly internet bill can be automatically categorized under “utilities” every time the transaction appears. This consistency saves time and improves the accuracy of your financial reports.

Multi-Bank Support

For businesses that deal with multiple bank accounts, credit cards, or even international accounts, Xero handles it all seamlessly. You can connect several accounts and reconcile them within the same platform, giving you a full financial picture at a glance.

Why Bank Reconciliation Matters for Small Businesses

Accurate books aren’t just about compliance—they’re essential for cash flow management. Small businesses often run into trouble because they don’t have a clear view of what money is available. With Xero’s daily reconciliation, you always know exactly where your finances stand.

This clarity helps with:

- Making better spending decisions

- Ensuring payroll runs smoothly

- Avoiding overdraft fees

- Keeping investors and stakeholders confident

4. Robust Invoicing and Payment Features

Cash flow is the lifeblood of any small business. You could have plenty of sales on paper, but if customers aren’t paying on time, your business can quickly run into trouble. That’s why Xero’s invoicing and payment tools are such a game-changer—they help you get paid faster, reduce admin work, and create a more professional experience for your clients.

Create Professional Invoices in Minutes

With Xero, you can design and send invoices that look professional and reflect your brand. The platform lets you:

- Customize invoices with your logo, colors, and payment terms

- Save templates for recurring use

- Add notes or personalized messages to clients

Instead of fumbling with Word docs or PDFs, Xero ensures every invoice is consistent and polished.

Send Invoices Anywhere, Anytime

Thanks to Xero’s cloud-based nature, you can send invoices from your laptop, tablet, or phone. Imagine finishing a job on-site and emailing the invoice to your client before you’ve even left the premises. This immediacy often results in quicker payments.

Online Payment Options

Xero integrates with payment providers like Stripe, PayPal, and Square, making it easy for clients to pay directly from the invoice. Instead of waiting for checks or manual bank transfers, customers can simply click “Pay Now.”

Studies show that businesses offering online payment options get paid up to twice as fast compared to traditional methods.

Recurring Invoices and Auto-Reminders

For businesses with regular clients, Xero allows you to set up recurring invoices. This is ideal for subscription-based services, retainers, or long-term contracts. The system automatically generates and sends invoices on schedule, reducing manual work.

On top of that, you can enable automatic payment reminders. If a client hasn’t paid by the due date, Xero sends a polite reminder email. This takes away the awkwardness of chasing payments while improving your cash flow reliability.

Real-Time Tracking

From your dashboard, you can instantly see which invoices are paid, pending, or overdue. This real-time visibility helps you prioritize follow-ups and plan cash flow.

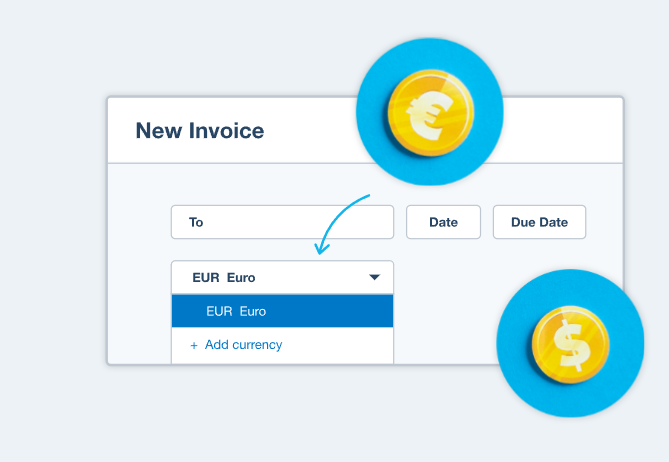

Multi-Currency Invoicing

For businesses dealing with international clients, Xero supports multi-currency invoicing. The software automatically converts currencies using up-to-date exchange rates, ensuring accuracy and saving you time.

Why Invoicing Matters for Small Businesses

Late payments are one of the top causes of cash flow issues in small businesses. By making invoicing seamless, professional, and connected to online payments, Xero helps you:

- Get paid faster

- Reduce manual follow-ups

- Build trust with clients through professional communication

👉 With Xero’s invoicing and payment tools, small businesses can finally stop worrying about unpaid invoices and focus on growth.

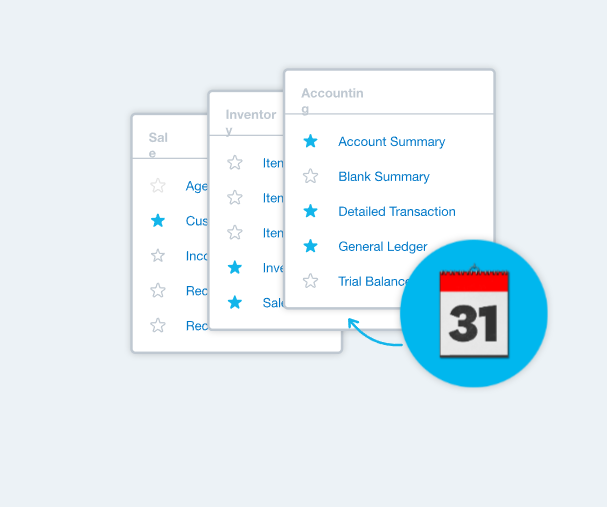

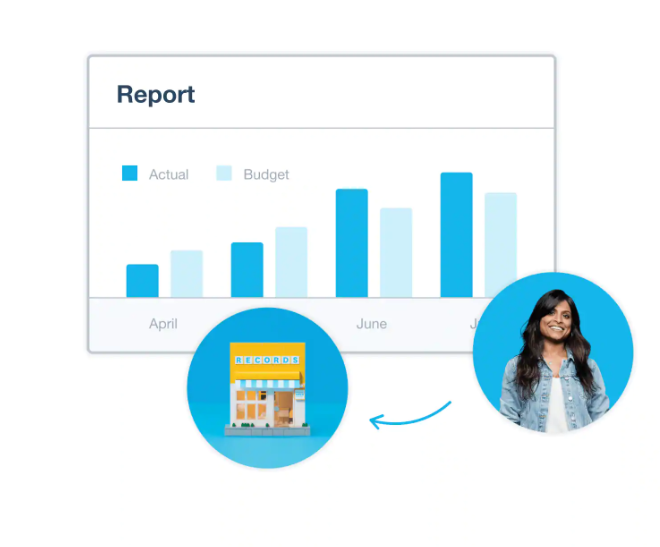

5. Real-Time Financial Reporting

Small businesses often operate on tight margins, which means having a clear, up-to-date picture of finances isn’t optional—it’s essential. Traditional accounting systems often rely on end-of-month reports, leaving business owners in the dark for weeks at a time. Xero changes this with real-time financial reporting.

Live Dashboard Insights

The moment you log into Xero, the dashboard gives you a real-time snapshot of your business health. You’ll see:

- Current bank balances

- Upcoming bills and due invoices

- Cash flow position

This transparency helps you make decisions based on facts, not guesses.

Dynamic Financial Reports

Xero offers a wide range of built-in reports, including:

- Profit and Loss (P&L)

- Balance Sheet

- Cash Flow Statements

- Budget Variance Reports

Unlike static reports, these are dynamic and customizable. You can drill down into transactions, filter by date ranges, or group data by customer, project, or account.

Forecasting Tools

Beyond standard reports, Xero provides forecasting capabilities. By analyzing your historical data and current financial position, you can project future cash flow and revenue. This foresight helps in planning growth strategies, hiring staff, or investing in new equipment.

Collaboration with Accountants

Real-time reporting also benefits accountants and bookkeepers. Instead of waiting for you to email them outdated spreadsheets, they can log into your Xero account and see live data. This makes collaboration more efficient and ensures advice is based on accurate numbers.

Visual and Accessible

One of Xero’s strengths is how accessible the reports are. Financial statements are presented with clear visuals—charts, graphs, and summaries that make sense even if you’re not a finance expert.

For example, instead of wading through numbers, you might see a simple graph showing revenue trends over the past six months. This makes it easier to spot growth opportunities or potential problems.

Compliance Made Easy

Keeping accurate, up-to-date financial reports isn’t just about running the business—it’s also about compliance. Whether it’s tax season, investor reporting, or applying for loans, Xero ensures your records are accurate and ready to share.

Why Real-Time Reporting Matters for Small Businesses

Small businesses succeed or fail based on their ability to manage cash flow and adapt quickly. With real-time reporting, you’re never left guessing about your financial health. Instead, you can:

- Make smarter spending decisions

- Spot problems before they escalate

- Prove financial stability to banks or investors

6. Affordable Pricing for Small Business Budgets

For many small businesses, affordability is a deciding factor when choosing accounting software. Big corporations might have large budgets for enterprise tools, but SMEs and freelancers need something cost-effective without compromising on features. Xero delivers exactly that balance.

Transparent Pricing Plans

Xero offers tiered subscription plans, meaning you can choose the one that fits your needs and budget. Typically, these include:

- Starter Plan – Best for freelancers and new businesses. Limited invoices and bills, but perfect for testing the waters.

- Standard Plan – Offers unlimited invoicing, bills, and bank reconciliation, ideal for growing businesses.

- Premium Plan – Adds advanced features like multi-currency support, suited for companies dealing with global clients.

Each plan comes with a 30-day free trial, allowing you to explore the platform before committing.

Start with Xero Promo Deal (90% OFF FOR 4 MONTHS)

If you’re ready to streamline your business’s financial management while saving significantly, there’s no better time to start with Xero.

This Xero promo code offers a whopping 90% off the original price for 4 months, an exceptional opportunity to access one of the world’s leading accounting software solutions at a fraction of the cost.

Value for Money

Compared to competitors like QuickBooks Online, Xero’s pricing often comes out more affordable for small businesses while still offering a wide range of features. QuickBooks may charge extra for payroll, multi-currency, or advanced reporting—Xero bundles many of these features into its mid-tier plans.

No Hidden Fees

One of Xero’s biggest advantages is its transparency. You pay a flat monthly fee per plan—no hidden charges for upgrades, patches, or updates. Even support and software enhancements are included in the subscription.

Scalability Without Financial Stress

Because the pricing is tiered, you only pay for what you need. If you’re a freelancer, the Starter Plan may suffice. As your business grows, you can easily upgrade to the next tier. This scalability ensures you’re not overpaying for tools you don’t yet need.

👉 In short, Xero’s pricing model respects small business budgets while delivering enterprise-level features, making it one of the most cost-effective solutions on the market.

7. Collaboration Made Simple

Accounting doesn’t happen in a vacuum. Business owners, accountants, bookkeepers, and even managers often need to work together to ensure smooth financial operations. Xero makes this process effortless with its built-in collaboration features.

Multi-User Access

Xero allows multiple users to access the same account simultaneously. Whether it’s you, your accountant, or your finance assistant, everyone can log in and see the same live data without version conflicts.

Role-Based Permissions

Not every employee needs access to all financial data. Xero lets you assign roles and permissions, ensuring sensitive data remains private while still enabling collaboration. For example, a sales manager might only see invoice-related features, while your accountant has full access.

Real-Time Collaboration with Accountants

Traditionally, business owners would export spreadsheets or email documents to accountants. With Xero, your accountant can log in directly to your account and make adjustments in real time. This reduces delays, errors, and endless back-and-forth emails.

Audit Trail Transparency

Xero records every action taken in the system. This means you can always see who did what and when, creating a transparent audit trail. This builds trust and accountability among your team.

👉 By streamlining collaboration, Xero ensures your financial management becomes a team effort rather than a solitary struggle.

8. Scalable Features That Grow with Your Business

into new markets, or launching additional services, your accounting needs evolve. Xero is designed to grow with you.

Start Small, Expand Seamlessly

You can begin with a basic plan that handles invoicing and reconciliation. As you expand, Xero offers advanced features like payroll, inventory management, and project tracking—available as add-ons or through integrations.

Industry Flexibility

From freelancers and consultants to retailers and manufacturers, Xero adapts to various industries. Its customizable chart of accounts and reporting features mean you can tailor it to your specific needs.

Add-On Ecosystem

Xero’s app marketplace (covered in the next section) makes it easy to scale functionality as you grow. Whether you need CRM, HR management, or e-commerce tools, you can integrate them without leaving Xero.

👉 With scalability built in, Xero ensures your accounting software never becomes a bottleneck as your business grows.

9. App Marketplace and Integrations

No software can do everything. That’s why integrations are so important, especially for small businesses that rely on multiple tools. Xero shines with its app marketplace of over 1,000 integrations.

Popular Integrations

Some of the most commonly used integrations include:

- Shopify for e-commerce

- HubSpot and Salesforce for CRM

- Gusto for payroll

- Expensify for expense management

- Stripe and PayPal for payments

Streamlined Workflows

These integrations allow data to flow seamlessly between platforms, eliminating manual entry. For example, sales recorded in Shopify can automatically sync to Xero, updating your accounts in real time.

Tailored Ecosystem

Because the marketplace is so extensive, you can build a software stack tailored to your unique business model. This modular approach prevents you from being locked into one rigid system.

👉 Simply put, Xero’s integrations make it more than accounting software—it becomes the hub of your business operations

10. Security and Data Protection You Can Trust

For many business owners, moving sensitive financial data to the cloud feels risky. But with Xero, security is top-notch, giving you peace of mind.

Bank-Grade Security

Xero uses bank-level encryption (SSL and TLS) to protect your data in transit and at rest. This ensures your financial records are shielded from unauthorized access.

Two-Factor Authentication (2FA)

To add an extra layer of security, Xero offers two-factor authentication. Even if someone steals your password, they cannot access your account without the second verification step.

Regular Backups and Redundancy

All data is backed up regularly and stored across multiple secure servers worldwide. This redundancy ensures your data remains safe even in the event of a server failure.

Compliance with Standards

Xero complies with international standards like GDPR and ISO/IEC security certifications. For businesses concerned about data privacy, this compliance is a huge reassurance.

👉 By prioritizing security, Xero removes the fear of cloud accounting and builds trust in digital transformation.

11. Customer Support and Community Resources

No matter how intuitive software is, users occasionally need support. Xero stands out for its customer service and vibrant community ecosystem.

24/7 Support

Xero provides round-the-clock support via email, chat, and an extensive knowledge base. Unlike some competitors, you don’t have to wait days for a response.

Xero Central

This is Xero’s online help centre, featuring tutorials, step-by-step guides, and FAQs. It’s especially helpful for beginners who want to learn at their own pace.

Partner Ecosystem

Xero has built a network of certified accountants and bookkeepers worldwide. This means you can easily find local experts trained in Xero to help manage your accounts.

Community Forums

The Xero community forum allows business owners to connect, share tips, and solve problems together. It’s not just about support—it’s about learning from others in similar industries.

👉 In short, Xero doesn’t just sell software—it builds a community that supports your business journey.

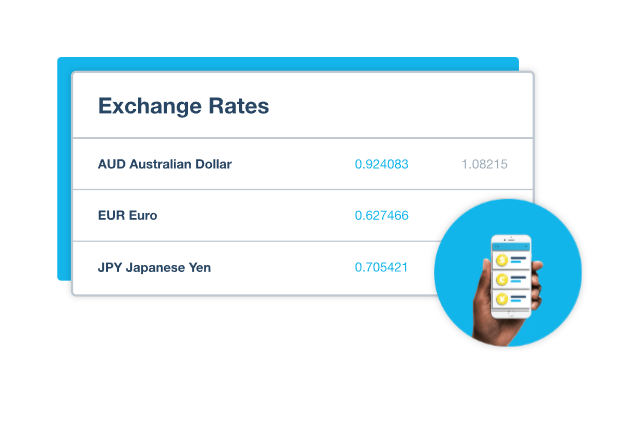

12. Global Reach and Multi-Currency Support

In today’s digital economy, many small businesses operate internationally, whether by serving overseas clients or sourcing products globally. Xero makes this easy with its multi-currency support and international reach.

Multi-Currency Transactions

Xero automatically updates exchange rates daily. This means invoices, payments, and expenses in foreign currencies are always accurate and up to date.

Global Network of Users

With millions of users across more than 180 countries, Xero has become a truly global solution. This makes it easier to find accountants or partners familiar with the software anywhere in the world.

Localization Features

Xero adapts to local tax rules and compliance standards in different countries. For example, it supports VAT in the UK, GST in Australia, and sales tax tracking in the US.

Why Global Features Matter

Even if your business is local today, the ability to handle international clients or suppliers gives you the flexibility to grow without needing a new system later.

👉 With its global reach, Xero equips small businesses to expand beyond borders confidently.

Conclusion: Why Xero Is the Future of Small Business Accounting

From its user-friendly interface to its global capabilities, Xero has proven itself to be the best cloud accounting software for small businesses. It combines affordability, powerful features, and scalability with unmatched security and collaboration tools.

By choosing Xero, entrepreneurs free themselves from the burdens of manual bookkeeping and outdated desktop systems. Instead, they gain a reliable financial partner that empowers them to focus on what matters most—growing their business.

For small businesses seeking a future-proof solution, Xero isn’t just an option—it’s the smart choice.